Foreign employees in Norway have the same rights to social security as Norwegians do, although all must meet certain criteria. The main requirement is to gain an income and pay social insurance contributions (trygdeavgift) in this country. As a result, immigrants can also count on help from the state with covering the costs of raising children.

This article presents the most important information on granting the most popular child benefits collected by foreign employees in Norway. Institution responsible for administering benefits described below is NAV (Arbeids- og velferdsetaten) – the Norwegian Labour and Welfare Administration.

Child benefit

The child benefit is granted to parents of children between 0 and 18 years old. The right to this benefit is acquired already after a month of work in Norway, so seasonal workes can take advantage of it as well. Thanks to the EEA-Agreement, the benefit can be also granted for a child who does not live in Norway, provided that the applicant participates in childcare and has had a common place of residence with the child in the EEA member state. Therefore it is possible to receive the benefit for children that live abroad even if one of their parents works in Norway. The ordinary child benefit is NOK 970 monthly per child.

Cash-for-care benefit

A cash-for-care benefit (kontantstøtte) is granted on a similar basis as child benefit. The primary difference concerns the age of the child – the benefit is intended for parents of children who are 13 to 23 months old. It has been implemented to help cover increased expenses in this period. The cash-for-care, like the child benefit, can also be granted to parents whose children live outside Norway.

The full amount of benefit is NOK 6000 monthly per child. It is required that parents applying for the benefit pay for child care themselves. If the child attends nursery school or day care center with state funding, the amount of benefit is reduced in accordance to the number of hours in a given facility. Parents of children who attend nursery 20 hours or more a week, are not entitled to the cash-for-care benefit.

Parental benefit

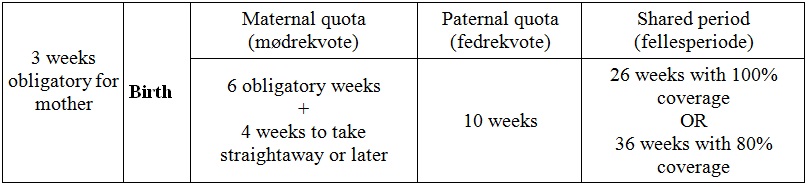

Norwegian parental benefit (foreldrepenger) is intended to ensure parents an income after birth or adoption (of a child who is not older than 15 years of age). It consists of three parts: maternal quota (mødrekvote), paternal quota (fedrekvote) and a shared period (fellesperiode). The total benefit period is 49 weeks at 100 percent coverage or 59 weeks at 80 percent coverage. To collect the benefit, at least one of the parents must have the right to it, which involves income achievement in Norway for at least 6 of the 10 months prior to the benefit period. Yearly income must amount to at least 0,5G (the base rate of the Norwegian social insurance scheme), which is equivalent to NOK 45 034 in 2015.

Benefit period for both parents is arranged as follows:

3 weeks before the birth and 6 weeks after the birth are reserved for the mother. If she is the only parent who has earned the right to parental benefit, the entire benefit period passes on to her – 49 or 59 weeks depending on the selected rate. However, if only father has meet the criteria, he can be granted the benefit for 40 weeks with 100% rate or 50 weeks with 80% rate. In this case, however, there is a certain activity requirement – the mother has to work or study for at least 75% of a usual full-time job. When the activity takes less than 75% of working time, the benefit is reduced accordingly. The benefit can also be granted during the child's stay in another country within EEA. It is also possible to combine benefit with a job and to draw a part of a parental benefit period at a later date. The beneficiary has to submit an application to NAV for this purpose.

Lump-sum grant on birth or adoption

The mother, who is not eligible to receive parental benefit, may receive a lump-sum grant on birth or adoption (engangsstønad ved fødsel og adopsjon). This lump-sum grant is, like the parental benefit, intended to ensure parents an income after birth or adoption (of a child who is not older than 15 years of age) and equals NOK 44 109 in 2015. In order to qualify for a lump-sum grant, the mother has to be a member of the National Insurance Scheme at the time of birth or adoption.

In some cases the allowance is granted to the father. This applies when the child's mother dies (not receiving a lump-sum grant before) or loses her parental rights and father has sole care for child. The amount can also be paid to a single father who adopts a child under age of 15 years.

Maternity allowance

Maternity allowance is paid to pregnant women who cannot continue working because it could pose a risk to a pregnancy – this fact has to be confirmed by a doctor or midwife. The factors threatening the pregnancy are for example physical work or working with chemicals. The allowance is granted if the employer has no possibility to assign other work tasks which could be harmless to a pregnant woman. A mother-to-be applying for the allowance has to achieve income in amount at least 0,5 G – NOK 45 034, while the minimum working period is 4 weeks. It is possible to get the maternity allowance partially and continue the work part-time.

Care benefit

The care benefit (omsorgspenger) has been designed to compensate for loss of income to employees, self-employers and freelancers who cannot work because they have to take care of children. These groups have a right to care benefit up to and including the calendar year when the child turns 12. If the child has a chronic illness or a disability, the right is extended up to the year the child turns 18. The main requirement is that the beneficiary has worked for the last 4 weeks and has lost revenue while taking care of the child.

Nursing allowance

Those who take care of a sick child or other close person in the terminal phase of life, can receive a nursing allowance in Norway (pleiepenger). One has to gain income for 4 weeks prior to the benefit period and lose income due to care of a sick person in order to be entitled to the nursing allowance. The right to this benefit have the caretakers of a child who is hospitalized or undergone clinical treatment. If a child is chronically ill or disabled, the right to benefit applies until the child turns 18. When taking care of someone who is mentally impaired, having a serious or life-threatening disease, the person is granted the nursing allowance regardless of age.

Other benefits for children

Apart from the benefits described above, it is possible to receive additional allowances, such as a supplement to unemployment benefit (dagpenger) or work assessment allowance (arbeidsavklaringspenger). Single parents are entitled to extended child benefit (utvidet barnetrygd), which is an ordinary child benefit plus additional NOK 970 every month.

Author: Anita Arcimowicz, Company Multinor

Source: www.multinor.no

Photos: CH/Visitnorway.com

EUR 4.2515 zł

EUR 4.2515 zł USD 4.077 zł

USD 4.077 zł DKK 0.5699 zł

DKK 0.5699 zł SEK 0.3706 zł

SEK 0.3706 zł NOK 0.3617 zł

NOK 0.3617 zł